SOL Price Prediction: Analyzing the Path to $400

#SOL

- Technical Strength: Price holding above key moving averages with improving momentum indicators

- Institutional Adoption: Major players like ARK Invest and Gemini showing confidence in Solana's infrastructure

- Market Sentiment: Divided between short-term bearish pressure and long-term bullish predictions

SOL Price Prediction

SOL Technical Analysis: Bullish Signals Emerge

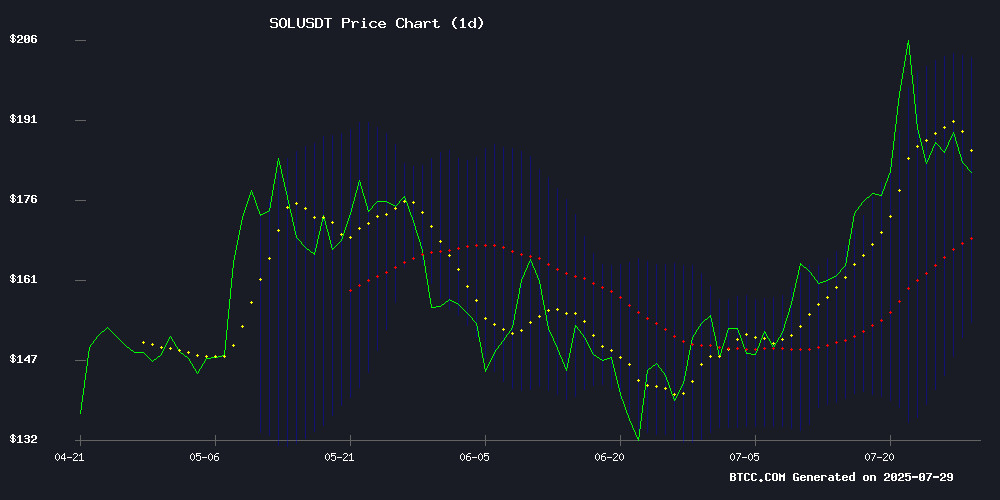

SOL is currently trading at $184.79, above its 20-day moving average of $178.12, indicating a potential bullish trend. The MACD shows slight improvement with a narrowing gap between the signal and MACD lines. Bollinger Bands suggest moderate volatility with the price hovering NEAR the middle band, which could act as support. According to BTCC financial analyst Robert, 'SOL's position above the 20-day MA and tightening Bollinger Bands suggest consolidation before a possible upward move.'

Mixed Sentiment as Solana Faces Key Resistance

Market sentiment around SOL is mixed with both bullish and bearish catalysts. While sell-side pressure has pushed the price below key support, institutional interest remains strong with ARK Invest delegating staking operations and Gemini AI predicting a rally to $400. BTCC financial analyst Robert notes, 'The $188 resistance level is critical - a breakout could validate the bullish institutional narrative despite short-term volatility.'

Factors Influencing SOL's Price

Solana Price Dips Below Key Support Level Amid Sell-Side Pressure

Solana's price has breached its critical support level at $184.13, signaling potential weakness in the near term. The cryptocurrency now trades below $183, with on-chain metrics and technical indicators pointing to growing bearish sentiment.

CryptoQuant data reveals a sustained negative trend in Spot Taker CVD, reflecting dominant sell-side activity across exchanges. This metric, which tracks the cumulative delta between buy and sell volumes over 90 days, has been declining steadily since turning negative last week - a classic hallmark of distribution phases.

Liquidity metrics compound the concerns. Artemis Terminal reports dwindling trader interest and reduced network activity, suggesting the current price action may lack fundamental support. Momentum indicators across timeframes show weakening bullish conviction, raising the probability of further downside before stabilization.

Upexi Expands $500M Equity Line to Boost Solana Treasury Strategy

Nasdaq-listed Upexi Inc. has secured a $500 million equity line agreement with A.G.P./Alliance Global Partners, signaling growing institutional confidence in solana (SOL). The flexible facility allows Upexi to issue common stock to fund corporate initiatives and accelerate its SOL accumulation strategy, with CEO Allan Marshall highlighting its cost-effective capital-raising potential.

The MOVE follows Upexi's July acquisition of 100,000 SOL via a $200 million private placement, bringing total holdings to 1,818,809 SOL ($331 million). Over half were acquired at discounted, locked-in rates—generating $58 million in unrealized gains—with nearly all tokens staked for an estimated $26 million annual yield. The firm's 'Basic mNAV' benchmark currently shows a 1.2x ratio of market cap to SOL reserves.

Despite the bullish fundamentals, SOL dipped 0.99% to $187.35 amid intraday volatility, trading between $186.38 and $194.99. The price action contrasts with Upexi's aggressive treasury strategy that continues positioning SOL as a cornerstone institutional asset.

ARK Invest Delegates Staking Operations to SOL Strategies, Enhances Security with BitGo

Cathie Wood's ARK Invest has made a strategic pivot into cryptocurrency infrastructure, partnering with SOL Strategies for staking services while integrating BitGo's security solutions. This move signals growing institutional confidence in blockchain's operational frameworks.

The collaboration underscores SOL's rising prominence as a platform for institutional-grade crypto services. BitGo's involvement adds a layer of institutional security standards to the arrangement, potentially setting a new benchmark for asset managers entering the space.

Solana Emerges as Key Player in Tokenized Real-World Assets (RWAs) Boom

Solana is rapidly becoming the blockchain of choice for tokenizing real-world assets (RWAs), with over $500 million in value flooding its network by mid-2025—a 200% surge this year. The platform's speed and low costs make it ideal for high-frequency trading and fractional ownership of tangible assets like real estate and commodities.

Token Extensions, part of Solana's Token-2022 program, are revolutionizing compliance by embedding legal rules directly into digital assets. This feature is attracting institutional players who require stringent regulatory adherence. Recent data shows a 680% monthly spike in wallets holding RWAs, signaling strong market momentum.

Projects like Homebase are democratizing access to real estate by slicing apartment buildings into $100 NFT shares. The ecosystem now spans everything from property to commodities, blending offline value with on-chain efficiency.

Solana Tests Key Resistance at $188 Amid Surging Volume and Institutional Interest

Solana (SOL) is navigating a critical technical juncture as its price tests the $188 resistance level, accompanied by a 103% surge in trading volume to $7.33 billion. The spike follows heightened institutional interest, notably from ARK Invest, underscoring growing confidence in the asset.

Technical indicators paint a mixed picture. SOL currently trades below the 50-day EMA but maintains support above the 100-day and 200-day moving averages, suggesting a resilient medium-term bullish structure despite short-term weakness. The RSI sits in neutral territory at 50, leaving room for either a breakout or correction.

Market participants are closely watching the $188 level, which could trigger explosive upside momentum if decisively breached. Conversely, failure to hold current levels may prompt a retest of lower support zones. The MACD histogram shows slight bearish divergence, though volume trends and institutional staking activity suggest underlying strength.

Solana CEO's 'Digital Slop' Remarks Ignite Debate on NFTs and Meme Coins

Solana Labs CEO Anatoly Yakovenko has sparked controversy by dismissing meme coins and NFTs as "digital slop" in a public exchange with Base creator Jesse Pollak. The debate, which unfolded on social media platform X, centered on the intrinsic value of these digital assets.

Yakovenko doubled down on his long-held view that such assets lack substantive worth, comparing them to loot boxes in free-to-play mobile games. His counterpart Pollak countered that NFTs carry cultural and artistic merit akin to fine art—valuable regardless of monetization potential.

The remarks drew sharp rebukes from some community members who credited meme coins with reviving Solana's ecosystem post-FTX collapse. Yet others found nuance in Yakovenko's stance, acknowledging the market's appetite for speculative assets regardless of their underlying utility.

Gemini AI Foresees Solana Rally to $400 by 2025, Highlights Snorter as High-Growth Opportunity

Google's Gemini AI has projected a bullish trajectory for Solana (SOL), forecasting a potential surge to $400 by the end of 2025. At its current trading price of $191, this prediction implies a 109% upside. The AI's analysis aligns with SOL's recent momentum—the token has rallied 29% over the past month, briefly touching $200 before consolidating. Market cap now exceeds $100 billion, supported by an 83% spike in 24-hour trading volume.

Gemini singled out Snorter, a Solana-linked project in presale, as a potential outlier. With $2.5 million already raised, the AI suggests SNORT tokens could deliver 50x returns post-launch. Technical indicators like RSI and MACD reinforce the bullish case, while institutional adoption grows through platforms like Superstate. Solana's rebound from June lows—now up 51%—reflects sustained demand despite minor profit-taking at resistance levels.

$500K Target? $23M SOL Pulled in 1 Day: Solana Price Prediction

Solana (SOL) is drawing significant attention as $23 million worth of the altcoin was withdrawn from exchanges within a single day. Whale activity suggests accumulating behavior, with technical charts indicating potential upward momentum.

Analysts speculate a bullish price target for SOL, though market conditions remain volatile. The sudden movement of funds underscores growing institutional or high-net-worth interest in the asset.

Forge: A Solana-Based Launchpad Empowering Token Creators

Solana-based tokens have surged in prominence over the past year, yet the path to sustainable success remains fraught with challenges. While launching a token has become technically trivial, gaining visibility, attracting liquidity, and fostering community engagement continue to elude most projects. Forge, a Telegram-native platform, aims to bridge this gap by offering end-to-end support for Solana token creators.

The platform distinguishes itself by addressing post-launch hurdles head-on. Beyond simplifying token creation, Forge provides tools for marketing, liquidity bootstrapping, and community development—critical components often neglected by existing solutions. Its creator-centric model grants unprecedented control over tokenomics, including customizable fee structures and a 50% revenue share on all transaction fees.

At its core, Forge recognizes that token generation is merely the starting point. In a market where thousands of new coins emerge daily, the platform positions itself as a catalyst for sustainable growth rather than just another launch tool. This approach reflects broader industry trends where infrastructure projects increasingly focus on post-launch viability as a key differentiator.

Solana Co-Founder's Meme Coin Comments Spark Industry Debate

Solana co-founder Anatoly Yakovenko ignited controversy by dismissing meme coins as "digital slop," drawing parallels to mobile game loot boxes. His remarks highlighted a tension between market demand and intrinsic value creation in cryptocurrency ecosystems.

Industry pushback was swift, with crypto influencer Beanie suggesting Solana WOULD resemble faded blockchain Tezos without meme coins and NFTs. OpenSea's CMO Adam Hollander called Yakovenko's stance "disappointing," while community members noted the irony given Solana's growth through its vibrant NFT marketplace.

Despite the internal debate, Solana maintains its position as the sixth-largest cryptocurrency with a $104 billion market capitalization. The controversy underscores ongoing tensions between purist blockchain ideals and the retail-driven phenomena fueling ecosystem activity.

Is SOL a good investment?

Based on current technicals and market developments, SOL presents an interesting risk/reward proposition:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | +3.75% above | Bullish momentum |

| MACD | -0.7335 | Bearish but improving |

| Bollinger %B | 0.55 | Neutral territory |

BTCC's Robert suggests: 'The combination of strong institutional interest and improving technicals makes SOL attractive for investors with 6-12 month horizons, though short-term volatility may persist.'

1